Contents:

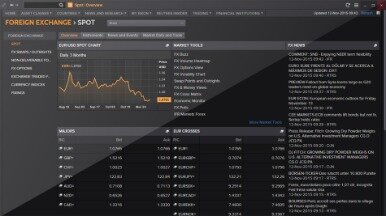

A consolidated tape is viewed as crucial to the next stage of growth for ETFs in Europe with investors currently unable to view the full liquidity picture of ETFs. The Barchart Technical Opinion rating is a 88% Buy with a Strongest short term outlook on maintaining the current direction. Barclays Bank PLC (“Barclays”) announced today that it will exercise its issuer call option and redeem, in full, each series of exchange-traded notes listed in the table below (each, an “ETN” and… Live educational sessions using site features to explore today’s markets. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov.

Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. To allow for equitable access to all users, SEC reserves the right to limit requests originating from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic.

How Do Leveraged Inverse ETFs and ETNs Work?

Top editors give you the stories you want — delivered right to your inbox each weekday. Currently, CFGE’s portfolio consists of about 35 individual holdings, with Apple, Google, and Facebook given the largest weightings. This report, created by WatersTechnology in association with Regnology, focuses on the state of play across the industry with regard to regulatory reporting. You are currently accessing WatersTechnology.com via your Enterprise account.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. This reinforces the need for a consolidated tape across fixed income and equity markets. Find exchange traded funds whose sector aligns with the same commodity grouping as the symbol you are viewing.

At maturity, they will pay the opposite of the return of the benchmark they track. You can also make money from them—and inverse ETFs—by selling them for more than your purchase price. These products are most often only for very short-term investments.

“UCITS products are very popular in those regions due to some of the withholding tax benefits compared to US ETFs but the lack of a consolidated tape is causing them hesitation and they still use US ETFs,” he stressed. One key benefit of aconsolidated tape for ETFs is the increased flow to European-listed ETFs. Shastry predicted the European ETF market is missing out on approximately $1trn assets from Asia and Latin America.

Last week was downbeat for the broader market owing to uncertainty over the signing of the ??? If you have any problems with your access, contact our customer services team. If you already have an account please use the link below to sign in.

Years of Modi Government and How India ETFs Responded

The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. The resulting portfolio consists of 25 individual stocks, most of which are large- and mid-cap companies.

Since Thursday, four new ETFs issued by Xtrackers are tradable on Xetra and via the trading venue Börse Frankfurt… “Growth of ETF AUM is being restricted with the lack of a tape due to buy-side clients not being able to see total volume efficiently and quickly in one place.” Barchart is committed to ensuring digital accessibility for individuals with disabilities.

Trading

The European ETF market may face alonger-than-expected waitfor a consolidated tape to be introduced with the European Commission planning to only focus on tapes for equities and bonds. The management team will factor in company fundamentals when building and rebalancing the portfolio, including global presence, strong and/or accelerated earnings growth, and solid returns on invested capital. Chicago-based Calamos launched its Focus Growth ETF , which began trading on July 15. The fund is actively managed and focuses on a select portfolio of equities issued by “blue chip” U.S. companies that offer opportunities for growth. The values of inverse ETFs and inverse ETNs are typically recalculated each day.

Inverse ETN market prices are determined in part by the performance of the underlying index. They are also affected by the perceived creditworthiness of their issuer. These derivatives often include various types of futures contracts. These are agreements to buy or sell a particular asset at a set price on an agreed-upon date. As a result, ETF share prices most often correlate to the net asset value of their holdings.

- Investopedia requires writers to use primary sources to support their work.

- The ETPs are used to create “short” positions, which bet on a down market, in a large number of securities, commodities, or currencies.

- TD Ameritrade is not responsible for the content or services this website.

- In ETF news, two new issuers made their debuts on Wall Street, while Barclays also launched a new inverse bond fund.

- The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

With T+1 compliance set to begin next May, firms will likely be burdened by reduced IT budgets, existing legacy systems and manual processes over the next 15 months. So, while faster settlement will help innovate the middle and back office, some argue industry needs a longer timeline. Inverse ETFs https://day-trading.info/ and ETNs aren’t for investors who don’t intend to actively monitor and manage their portfolios. You should conduct thorough research before committing money to any inverse ETPs. If they are, they aim to offer a return two to three times the inverse return of their underlying benchmark before fees.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. February ETF flow figures from iShares at BlackRock reveal that inflows into global ETPs were moderate for a fifth consecutive…

Issuers Make Their Debut on Wall Street; Barclays Launches TAPR

Inverse ETFs use derivatives to mimic the opposite performance of their underlying benchmark. Derivatives are financial instruments that derive their value from other instruments. In addition, inverse ETPs usually have higher expense ratios than those of other ETPs. That’s because of the frequent buying and selling of their underlying derivatives.

Consolidated tape is an electronic system that collates real-time exchange-listed data, such as price and volume, and disseminates it to investors. “ETFs have proved extremely resilient through the recent period of market volatility and additive to the overall functioning of markets. The European ETF industry has benefited from the execution transparency delivered through MiFID II by enabling market participants and sophisticated investors to see the volume of ETF trading that occurs daily. You are now leaving the TD Ameritrade Web site and will enter an unaffiliated third-party website to access its products and its posted services. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Trading–Leveraged Debt

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year. These returns cover how are currency exchange rates determined a period from January 1, 1988 through February 6, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

Inverse ETFs are funds whose underlying assets perform opposite of the stock index the fund tracks. Here we highlight the currency ETFs that were a hit or miss with investors in terms of performances in 2019. The Nasdaq launched a Government Relief Index on Jan. 5 to measure the performance of companies receiving TARP money, and now investors want a piece of the action. The vast majority of US-based active traders say they are knowledgeable about ETFs, and feel confident they…